News26 Jun 2024

Andrew Douthwaite – winner in Accountancy Age’s Top 35 Under 35

We have pleasure in congratulating partner Andrew on his outstanding achievement.

Articles

How will this growing sector be affected by possible changes brought about by Brexit?

Jason McGillivray joined Alliotts for work experience this Summer. Here is his analysis of the effect that Brexit may have on the UK video games industry.

Brexit is a key factor affecting the business for companies within the UK. Due to the strong business relationship with the EU, accounting for 43% of UK exports in 2016, many UK companies are worried over future prospects for growth post Brexit (https://www.bbc.co.uk/news/business-43212899).

With the date fast approaching for the UK to leave, it is looking more and more like there will be a hard Brexit from the EU, where Dominic Raab would have not reached agreeable trading terms with the EU negotiators. According to opponents of the “hard Brexit” strategy, this could not only affect imports of goods and services for creating products and services by UK businesses, but could also raise food prices and cause shortages in shops (https://www.bbc.co.uk/news/uk-politics-44858385).

Project FEAR is a main cause of such comments. Centred around pro-EU, Brexit sceptics – the arguments put forward are completely at odds with the pro-Brexit, EU sceptics who argue these tactics are nothing but scare-mongering. Both sides present valid reasons for and against Brexit, but with the decision made two years ago and deadline day fast approaching; the effect of the referendum on UK businesses has become more important (https://www.theguardian.com/commentisfree/2018/aug/21/brexiteers-project-fear-expert-warnings).

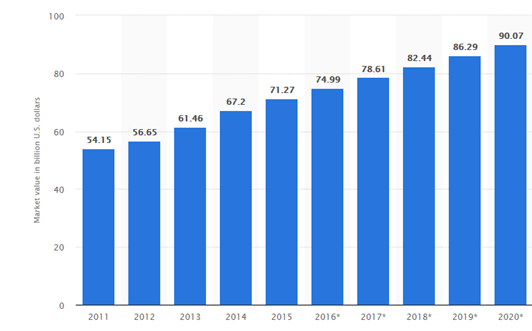

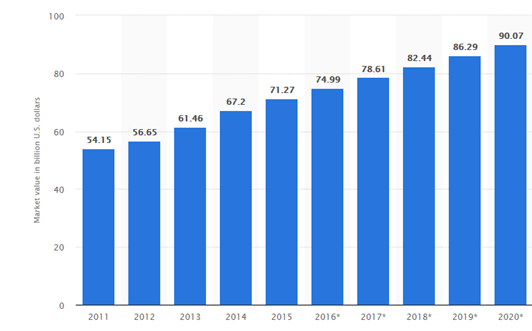

(https://www.statista.com/statistics/246888/value-of-the-global-video-game-market/)

Video games are a key part of the entertainment industry with the sector growing from $54.1 billion in 2011, to $90 billion by 2020 (predicted).

The video games industry has expanded well past the days of Space Invaders or Donkey Kong on arcade machines, with the introduction of new platforms – expanding and creating markets on which games companies can sell their products. These platforms range from personal gaming computers to consoles (the PlayStation, Nintendo Switch and Xbox) and also encompass the mobile phone market: all of which have app/game stores for consumers to purchase services in return for their money.

In 2016, consumers spent $44.8Bn on mobile apps (82% of this was on games) (https://ukie.org.uk/news/2017/03/uk-games-market-worth-record-%C2%A3433bn-2016). In the same year the market values of the global and UK video game industries were $74.9Bn and $4.33Bn respectively (https://ukie.org.uk/sites/default/files/UK%20Games%20Industry%20Fact%20Sheet%20June%202018_0.pdf).

UK tax incentives for game companies

One main incentive for growth in the games industry in the UK is the introduction of Video Game Tax Relief (VGTR) from the 1st of April 2014. This is a tax relief that can be claimed by UK game developers, providing that they are producing games which qualify. It can be claimed if: the video game is British; is intended for supply; at least 25% of core expenditure is incurred on goods or services that are provided from within the European Economic Area (EEA). The tax relief system defines core expenditure as costs of designing, producing and testing the game, which can be claimed against separately of R&D tax relief – unless the company falls under the large scheme (relief under the large scheme is not considered state aid relief).

Provided these conditions are met, the company can receive additional deductions in computing their taxable profit; and surrender losses for a payable tax credit, where deduction has resulted in a loss (https://www.gov.uk/guidance/corporation-tax-creative-industry-tax-reliefs#video-games-tax-relief-vgtr).

In order to maximise the effect of this the UK government specifically allows 25% tax relief on 80% of its’ total EEA qualifying spend on a game (https://www.alliotts.com/blog/what-is-video-games-tax-relief-six-things-you-need-to-know/). In order to make sure it qualifies, a company must pass the cultural test for video games, which requires 16/31 points scored in order to qualify (https://www.bfi.org.uk/film-industry/british-certification-tax-relief/cultural-test-video-games/summary-points-cultural-test-video-games).

(https://www.bfi.org.uk/film-industry/british-certification-tax-relief/cultural-test-video-games/summary-points-cultural-test-video-games).

The map above shows the locations of the 2,261 active games companies as of June 2018 (https://gamesmap.uk/#/map).

The UK video games industry accounts for about £1.5Billion of UK GDP and plays a key role in generating revenue as part of the global games industry (https://www.gamesindustry.biz/articles/2018-02-01-uk-game-dev-sector-grows-more-than-four-times-the-rate-of-the-economy-in-2017). The UK has an estimated 2,261 active games companies as of June 2018, with gross value added of £755million in 2015 (https://ukie.org.uk/research#Contribution).

However, this will need to be reworked as a result of Brexit, which will probably remove Britain from the EEA and create a barrier for UK companies promoting and selling to European customers. The resultant tariff could be the as the EU currently applies to countries such as the US which affects most products imported into the EU.

Despite this, the global games market in 2017 recorded that the UK was the 5th largest video game market (32.4million people), after China, the USA, Japan and Germany (https://ukie.org.uk/research). As the largest markets for games are still primarily outside Europe – one could argue that the impact of the loss of EEA membership is minimal and that the UK game industry may suffer a small drop in growth over the Brexit period, but ultimately will be fine.

However, the Brexit vote has left many of the UK games companies considering the likelihood of a less prosperous future as both a hard and a soft Brexit will result in more strenuous ties with Europe for the purpose of trade.

With a hard Brexit, the EU could charge extra duties to be added to the UK game industry products imported into the EU. In-turn, the effect of this would reduce profit margins and resultant R&D spending on development of technology.

On the other hand, this does allow the UK to set its own tariffs, with discussions over adopting regulations similar to the EU’s in place to avoid the prospect of a hard Brexit creating a trade barrier between the UK and EU. Also, being free from trade restrictions would allow new trade agreements to be formed with other nations in order to fill the gap in trade, these could ultimately stimulate the UK game market and encourage growth – however, this is likely to be over the mid to long-term rather than short to mid-term.

Jason McGillivray

More & Other Musings

View all related contentNews26 Jun 2024

We have pleasure in congratulating partner Andrew on his outstanding achievement.

Articles31 May 2024

Andrew Douthwaite shares practical tips on financial health with emerging games studios

News15 Apr 2024

Alliotts' supports Games London's 'Game Finance Market' event

Articles8 Feb 2024

There are always winners and losers when tax changes take place, but here are the basic differences between the old VGTR and the shiny new VGEC

Articles14 Dec 2023

Listening to ambitious entrepreneurs and investors helps ensure our outsourced services are aligned to their needs